Q4 Marin Market Update: What happens when inventory is down and interest rates go up?

2021 vs. 2020

$1.675M

MEDIAN SALES PRICE UP 16.3% ▲

$944

MEDIAN PRICE/SQFT UP 16% ▲

14

AVG. DAYS ON MARKET DOWN 44% ▼

2707

PROPERTIES SOLD UP 17% ▲

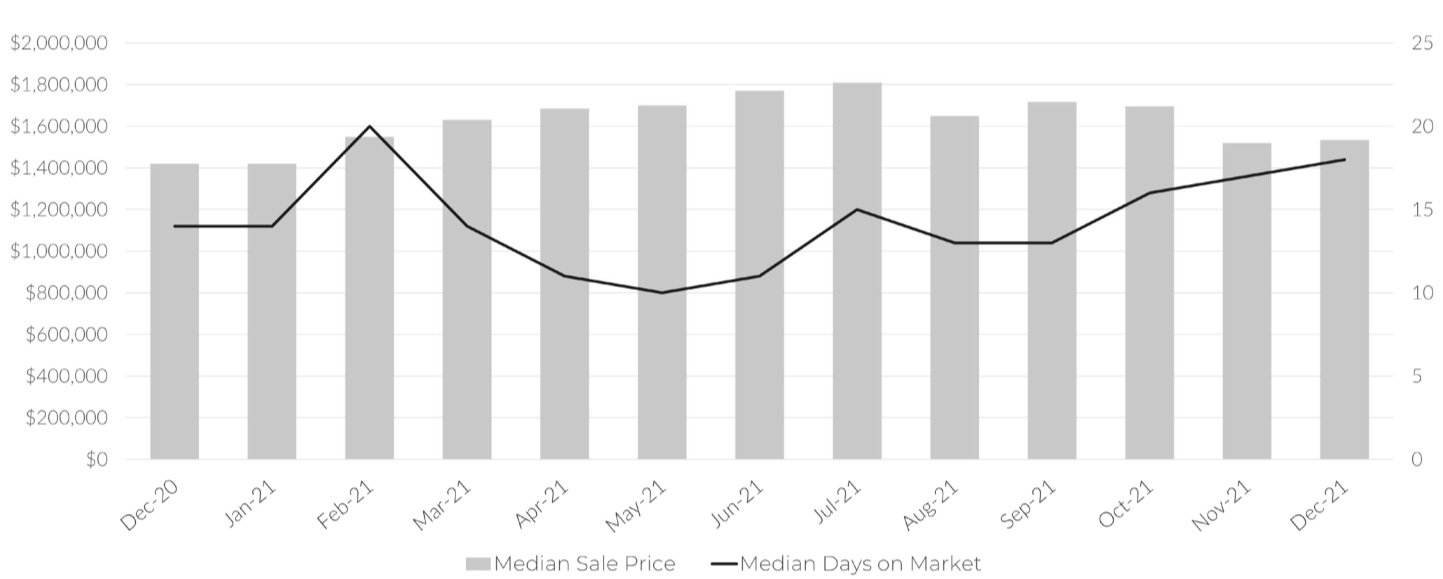

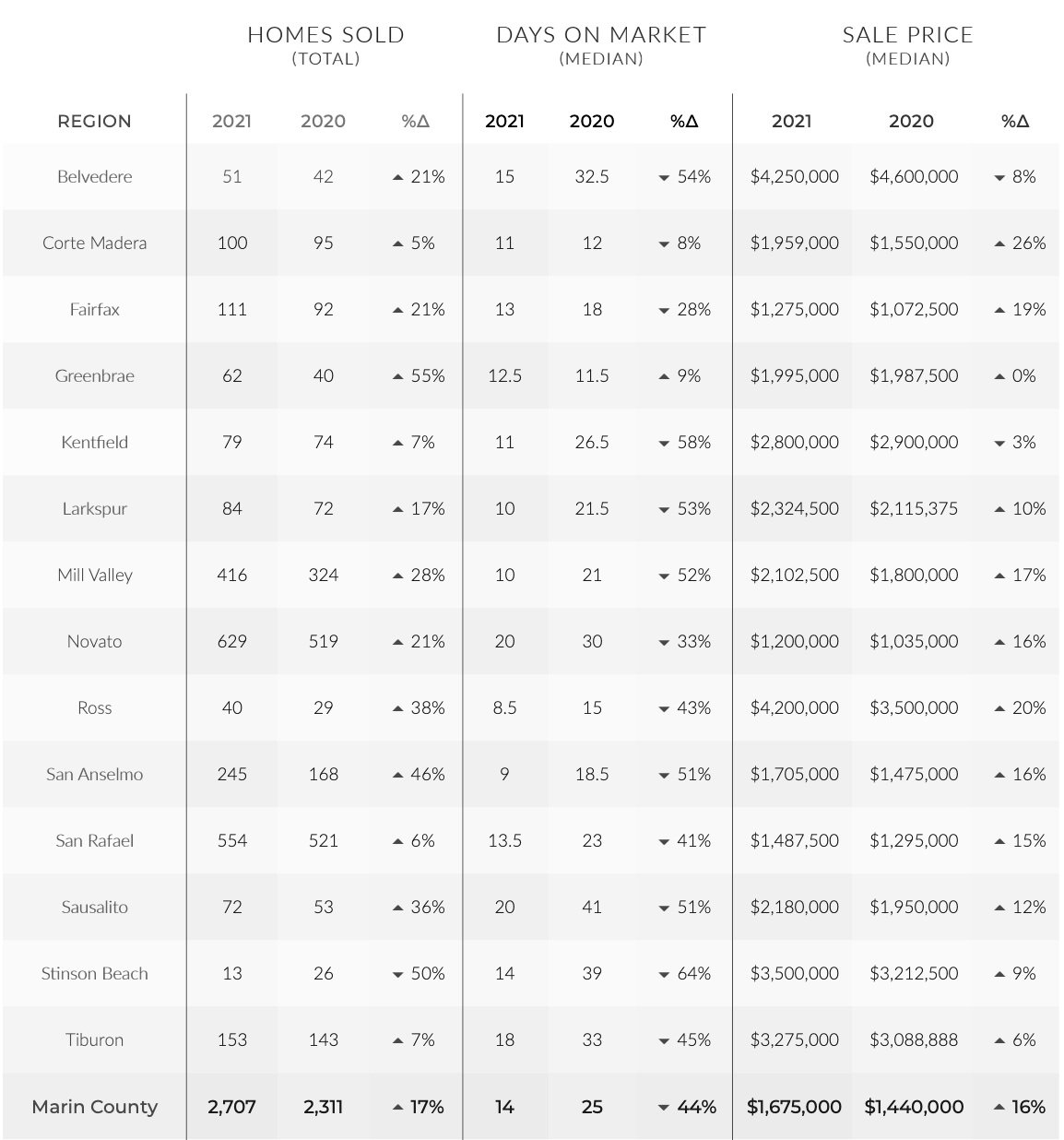

The Marin County real estate market had a banner year in 2021 with the busiest spring on record, followed by a holiday slowdown. The reason for the slowdown appeared to be a lack of inventory more than a lack of demand. In fact, in 2021, there were more documented residential sales in Marin County than in the past decade. The median sales price for single-family houses increased 16.3 percent as a result of the increased demand.

Interest rates have risen dramatically in recent weeks — almost a full percentage point since the start of the year. Rates are expected to continue rising in 2022, although salary growth may assist to offer a balance for purchasers. Mortgage rate spikes have had no effect on purchase demand so far this year, but given the rapid rise in home prices, increasing rates are expected to impact demand in the near future.

Sellers looking to sell at the “top of the market” would be wise to take advantage of the buyer demand in 2022 while inventory remains low and before interest rates increase towards the end of the year. For home buyers, inventory is expected to replenish this Spring but overall will still remain tight and mortgage rates may start affecting overall affordability.

If you’re considering making a move in 2022, reach out to one of our team members and we’ll be happy to help you achieve your real estate goals this year.

TOTAL

2021 vs. 2020

MONTH-OVER-MONTH COMPARISON

YEAR-OVER-YEAR REGIONAL COMPARISON

FEATURED 2021 SALES

Seller Representation

5 BD • 2.5 BA • 2,495± SQFT

Buyer Representation

3 BD • 3 BA • 3,287± SQFT

Seller Representation

4 BD • 3 BA • 1,826± SQFT

Buyer Representation

4 BD • 3 BA • 2,762± SQFT

Buyer Representation

4 BD • 3 BA • 2,500± SQFT

Seller Representation

5 BD • 3.5 BA • 2,950± SQFT

Buyer Representation

3 BD • 5 BA • 3,767± SQFT

Buyer Representation

4 BD • 3.5 BA • 4,203± SQFT

Buyer Representation

4 BD • 3 BA • 2,865± SQFT

Buyer Representation

4 BD • 3.5 BA • 3,330± SQFT

Buyer Representation

5 BD • 4.5 BA • 3,545± SQFT

Buyer Representation